Democrat leader November-December 2010 (Number 121)

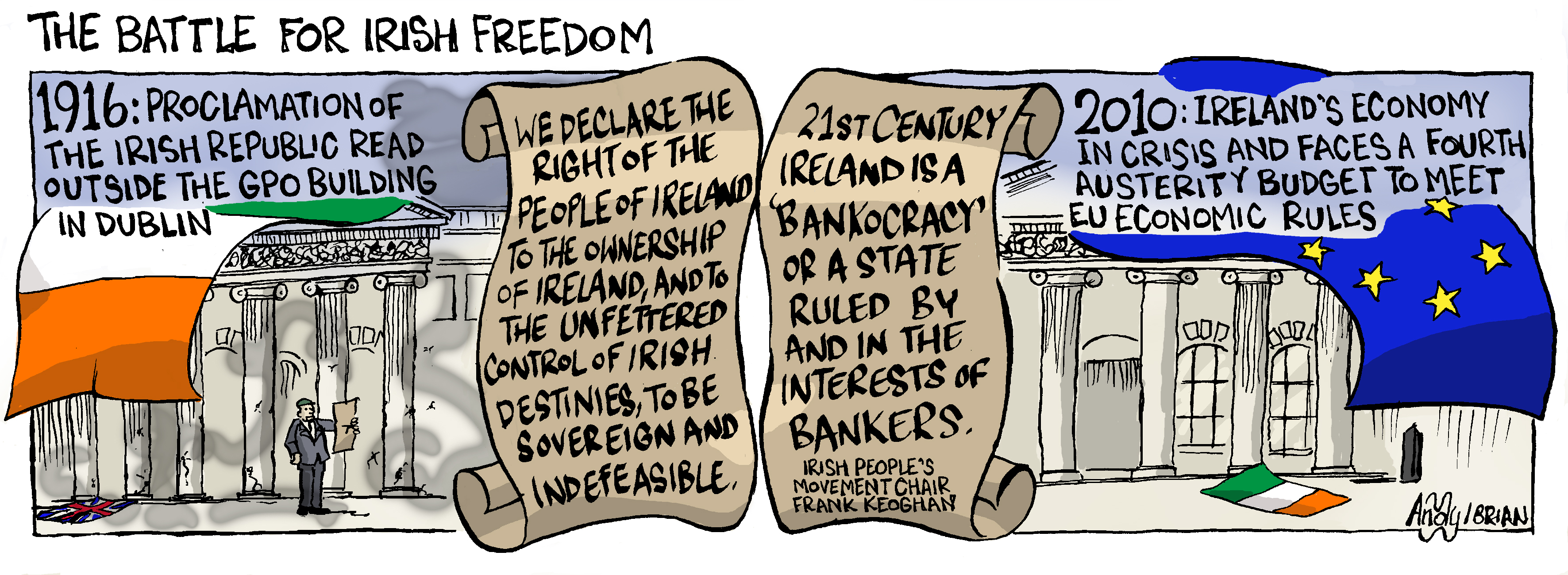

EU forces Ireland into perpetual poverty

EU forces Ireland into perpetual poverty

Brian Denny

Ireland has been forced to accept a 85bn euro bail out, following huge pressure from large EU countries and the European Central Bank.

Brussels has dictated a very harsh austerity budget for the country to pay for it, including huge cuts in public spending, wages and jobs, forcing Irish citizens to pay for the financial mess caused by Irish membership of the eurozone and the banks.

The bail out money will be paid out to French, German and British banks which had lent money to Irish banks to gamble - and lose - on the international markets. In other words the EU is protecting the financiers and bankers not jobs, standards of living or public services.

Following the bail out Irish People’s Movement chair Frank Keoghan said that “Irish taxpayer money has been diverted to the foreign investors who had been only too happy to make money stoking the asset bubble.

“This is happening while basic social provisions and protections are being dismantled,” he said.

This is completely in line with EU policy, whereas government action on unemployment, investment in public services, and other measures necessary to defend working people would be considered a threat to the EU monetary union.

Mick O’Reilly of the Dublin Trades Council said that “the EU-IMF bailout and government’s four year plan will copper-fasten the stranglehold of EU and international finance on the Irish economy to the extent that it threatens to undermine the productive and profitable sectors of the economy”.

Calls are growing in Ireland to default on the debt which is no fault of the Irish taxpayer.

Bail out

The bail out money will come from the IMF and two separate EU bail-out schemes - one including only eurozone members, and the other underwritten by all 27 member states, including Britain.

Britain’s share in the Irish bail-out is estimated at 7bn euro, with 3.8bn euro of this coming through voluntary bilateral loans. British taxpayers already pay about £4bn a year to the EU and this is expected to go up to £7bn by 2012 to nearly £10bn by 2014.

Should the contagion spread to other countries like Portugal and Spain and they are forced to accept bail-outs, the UK could in total be liable for at least £20bn - or £773 for every British household - through commitments already made under the bailout agreement and bilateral arrangements.

The announcement of the Irish bail-out failed to wipe out fears of contagion to other eurozone countries. Borrowing costs for Portugal, Spain, Italy and Belgium continue to go up, prompting worries that the eurozone is facing even bigger problems down the road.

EU finance ministers have also outlined a new permanent crisis resolution mechanism and bail-out fund for the eurozone, due to replace the current rescue package in June 2013.

There is an alternative. Get out of the EU.